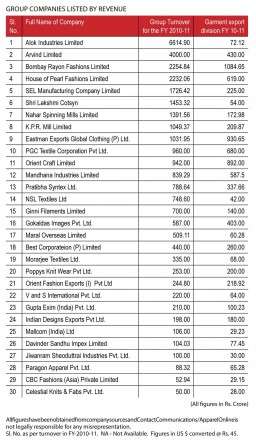

Over the second half of 2011, AO carried many articles on the global economic slowdown and how it has impacted business for the industry. Yet in our ‘IndustryWire’ segment, we continued to carry reports from different companies on their ongoing expansions or plans for expansions in the coming year. Going through the responses received from various players for the AO Top 100 listing, it was heartening to know that 48% of the respondents planned to make an investment in 2012. Though not everyone filled up the domain, the positive responses indicate that the industry is planning for the future and is not simply looking to ‘let the phase pass by’. Even more encouraging was the fact that the intention to invest is not limited to big players, though the integrated set-ups are at the forefront of planning for the future.

Textile mills have heavy investment planned for growth

The company that indicated the maximum focus on expansion was Ludhiana based-SEL Manufacturing Company. With a group turnover of Rs. 1726.42 crore, the company under the dynamic leadership of Neeraj Saluja is looking to invest about Rs. 4000 crore on expansion/new projects coming up in spinning, terry towels, denim fabrics and denim garments. SEL employs around 10,000 people with a senior team of about 100 and support team of nearly 1000 employees.

Another company looking for major investments is Alok Industries, which is investing Rs. 1250 crore on expanding its capacities in spinning, apparel fabrics and polyester yarn. Alok is a big name in the textile segment and with a group turnover of Rs. 6,614.90, the garmenting share is worth only Rs. 72.12 crore, manufacturing knitted and woven sportswear, active wear, casual wear and sleepwear garments for ladies, gents and children. With factories in Silvassa, Vapi and Navi Mumbai, the company employs 32,272 people of whom a majority is male (27,772).

The integrated set-ups are really looking at expansions and Kanpur based Shri Lakshmi Cotsyn Limited is planning a Rs. 992 crore investment, which includes Rs. 510 crore in denim and sheeting and Rs. 482 crore in technical textiles. So far as apparel is concerned the company is selling products under the “DYFI” brand through 11 distributors, 400 retailers and 8 franchised stores. The strategy is to increase the number of franchisee stores to 100 in the next 2 years. In fabrics, Shri Lakshmi Cotsyn specializes in black out fabric, flex fabric, nuclear bio chemical fabric, multi spectrum camouflage net and micro dot fusible interlining.

KPR Mills, also an integrated set-up with a group turnover of Rs. 1,049.37 crore, is looking to invest around Rs. 335.87 crore on compact spinning and Rs. 17.72 crore on mélange yarn. The garmenting segment at KPR accounts for nearly 20% of the turnover and is currently not the focus of the company. For Mandhana Industries, the focus is certainly on garments and the company is looking at investing Rs. 230 crore most of it for the garment manufacturing segment. Nahar Spinning Mills is investing Rs. 65 crore completely for its garment export division and is looking to expand its presence in the segment.

Garment exporters also to invest…

Modelama Exports, Gurgaon is committed to invest Rs. 30 crore on expanding capacities in outwear and Indian Design, Bangalore is coming up with a new facility of 25 lines with an investment of about Rs. 25 crore to be operational in 2012. The company with a turnover of Rs. 180 crore is employing around 9000 people. Kolkata-based Jiwanram Sheoduttrai Industries has set aside an investment of Rs. 40 crore to expand their knitwear, fabrication and readymade apparel segment. The company with a group turnover of Rs. 100 crore is generating a turnover of Rs 30 crore from the garment export segment, specializing in industrial work wear, safety wear and casual wear.

Many smaller investments from Rs. 8 to Rs. 20 crore are going to be made to increase capacities mostly in already existing lines or to add value to operations. Nancy Kraft, New Delhi is investing Rs. 8 crore to set up a unit for high value garments with heavy embellishments, while CTA Apparels is looking at knitted high fashion garments and lingerie with an estimated investment of Rs. 20 crore. Faridabad-based Gupta Exim is planning to invest around Rs. 22.50 crore on existing operations to make the factories more productive and efficient.

Backward integration into fabric processing is the focus at Tirupur based Unisource Trend India, while at SCM, also Tirupur based the direction is new dyeing machines and a new production unit towards the year end. Shine India with a group turnover of Rs. 337.50 crore is exploring opportunities to buy a stake in multinational company to increase sales (South Africa) and Malwa Industries is looking at expanding jeans wear. Even the smallest company on listing, Chennai-based Meenakshi (India) Limited, with a turnover of Rs 20.21 crore, is looking at an investment of Rs. 2.50 crore to strengthen its operations.

Textile companies increasing focus on garmenting…

30 companies from the top 100 garment exporters claim to have other operations too that generate revenue. These companies are spread across the country, and 10 of them are basically textile mills that have forward integrated into garments which includes Alok Industries, Arvind Mills, SEL Manufacturing, KPR Mills, Mandhana Industries, NSL, Ginni Filaments and Morarjee Textiles.

In terms of Group revenues Alok Industries is the largest textile mill with garmenting operations, though the share is very small at 1%. For Alok, garment exports is still a minor segment with focus on other areas like fabric and home furnishing.

Bombay Rayon Fashions, at third position, has a garment segment that accounts for 48% of total revenue. For BRF, garmenting is a major growth segment and the company has been acquiring garment manufacturing companies to strengthen their presence in the garment export industry.

For integrated mills in Tirupur, garment exports is a major growth area with companies like Eastman Exports, PGC, Best Corporation Poppys and CBC Fashions all having a major presence in the segment, in fact the share of garment exports outstrips the revenue generated from other divisions.

Coimbatore based KPR Mills is an exception with fabric taking a major share and garment exports accounting for only around 20% of their total revenue.

Companies in Delhi-NCR are focusing on home furnishing and domestic segment in addition to garment exports, which accounts for the difference in group revenue and that generated from garment exports.

Two companies, House Of Pearl Fashions and Mallcom India have major overseas operations. While House Of Pearl Fashions generates Rs. 1,613 crore revenue from offshore operations, Mallcom generates around Rs. 77 crore from offshore operations.

Post a Comment